Sarthi is an AI-driven recommendation engine with DSP mutual fund app to discover funds aligned with your investment goals. Its purpose is to guide the investor (especially newer users) by assessing risk/goals and recommending schemes to the users accordingly.

Client

DSP Asset Managers

Year

2022

My Role

UX & UI

Category

FinTech

Overview

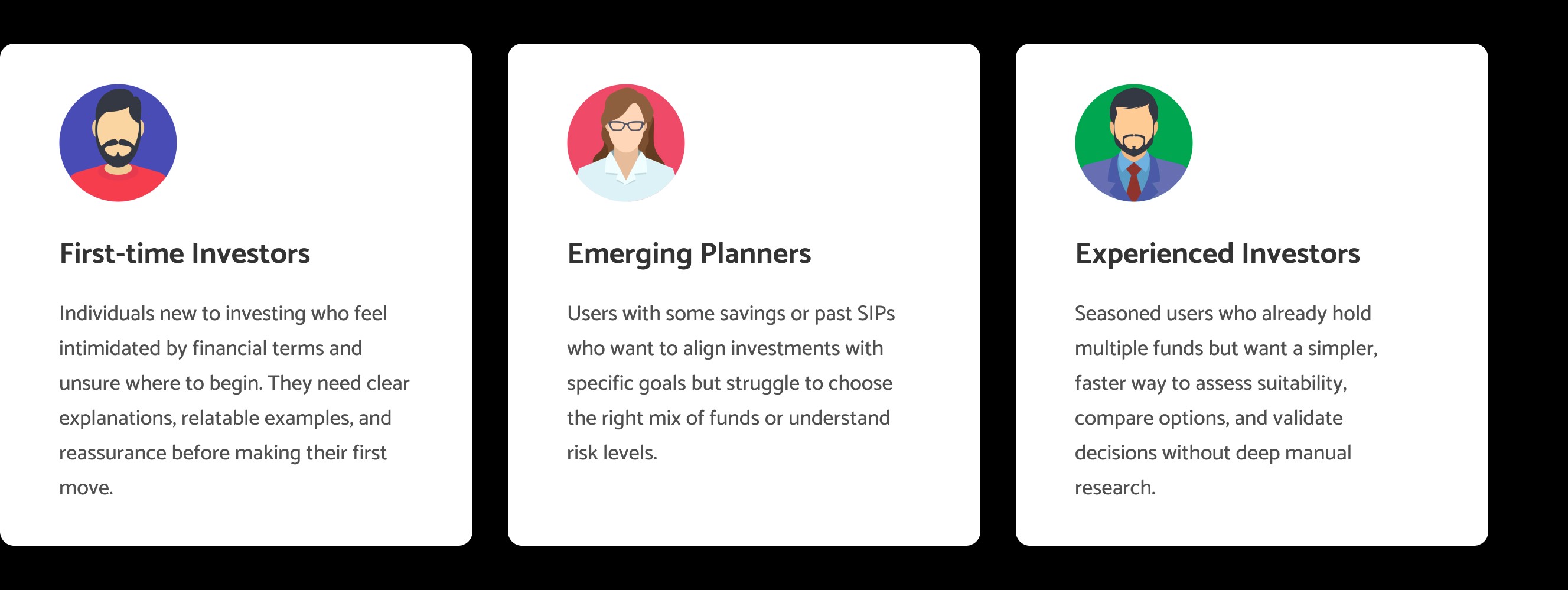

Users on DSP’s platform struggled to choose the right mutual fund due to overwhelming options, jargon-heavy content, and limited guidance—especially first-time investors who lacked clarity on where to start. This led to long browsing sessions, decision fatigue, and low conversion rates.

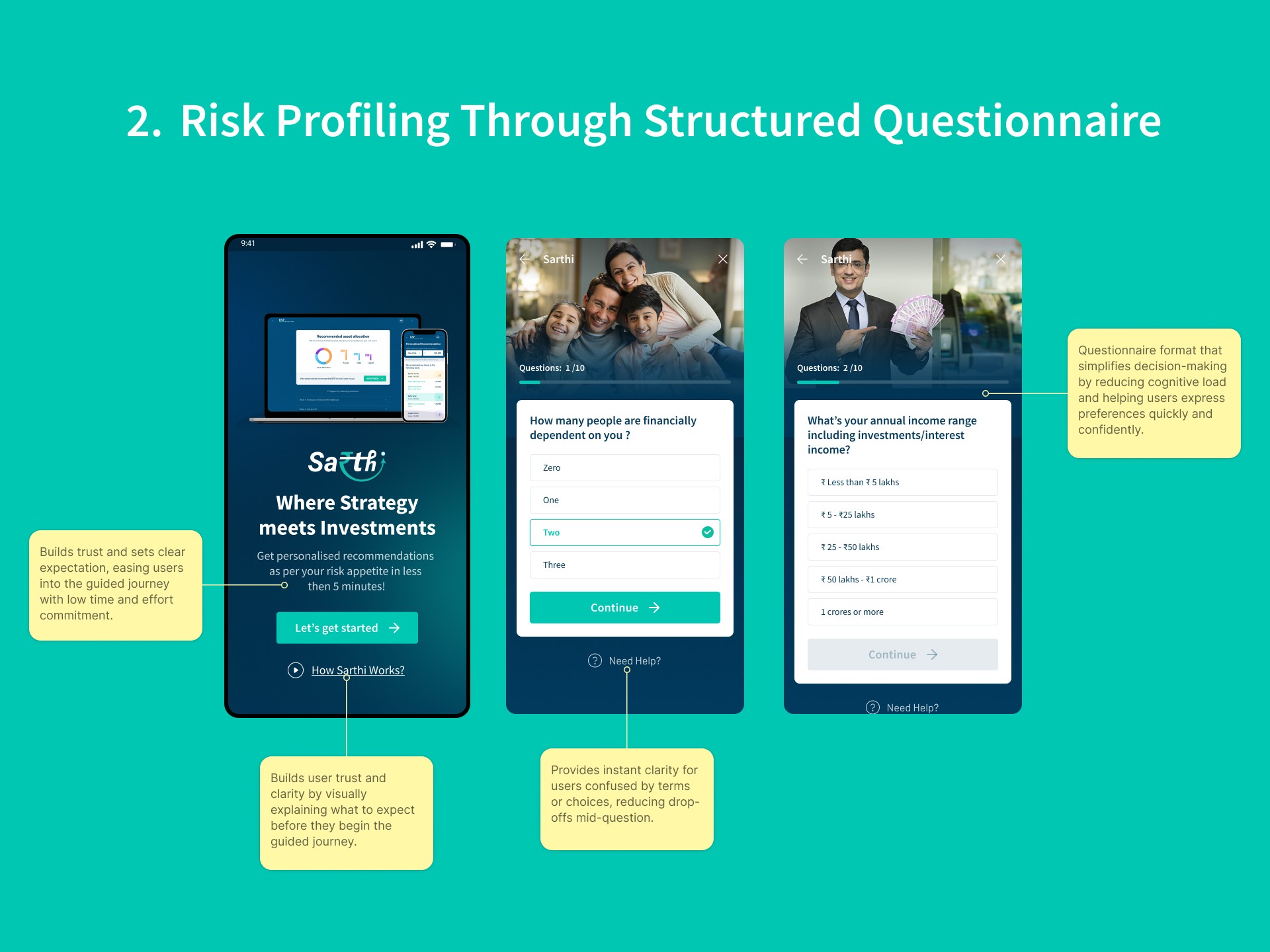

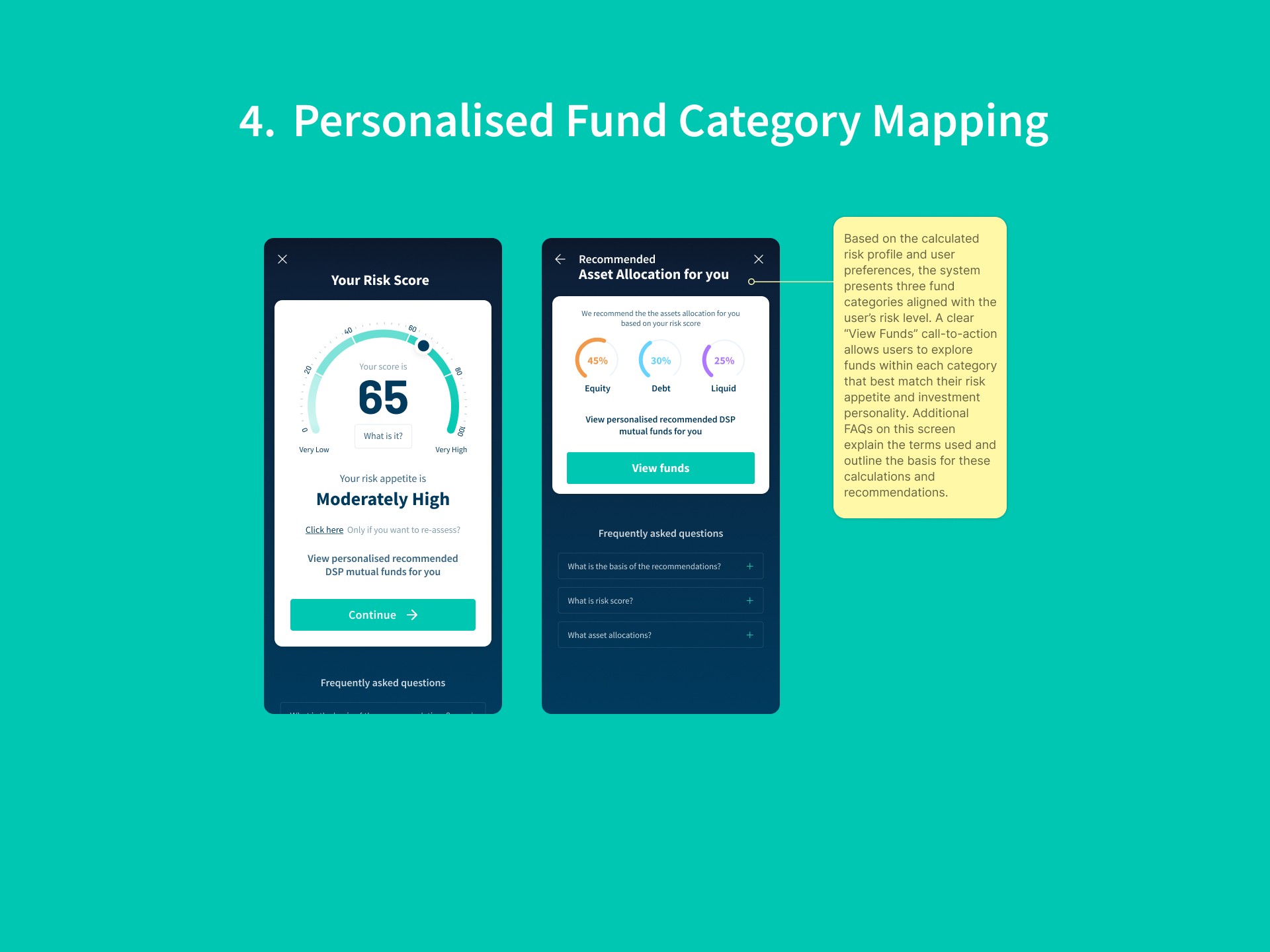

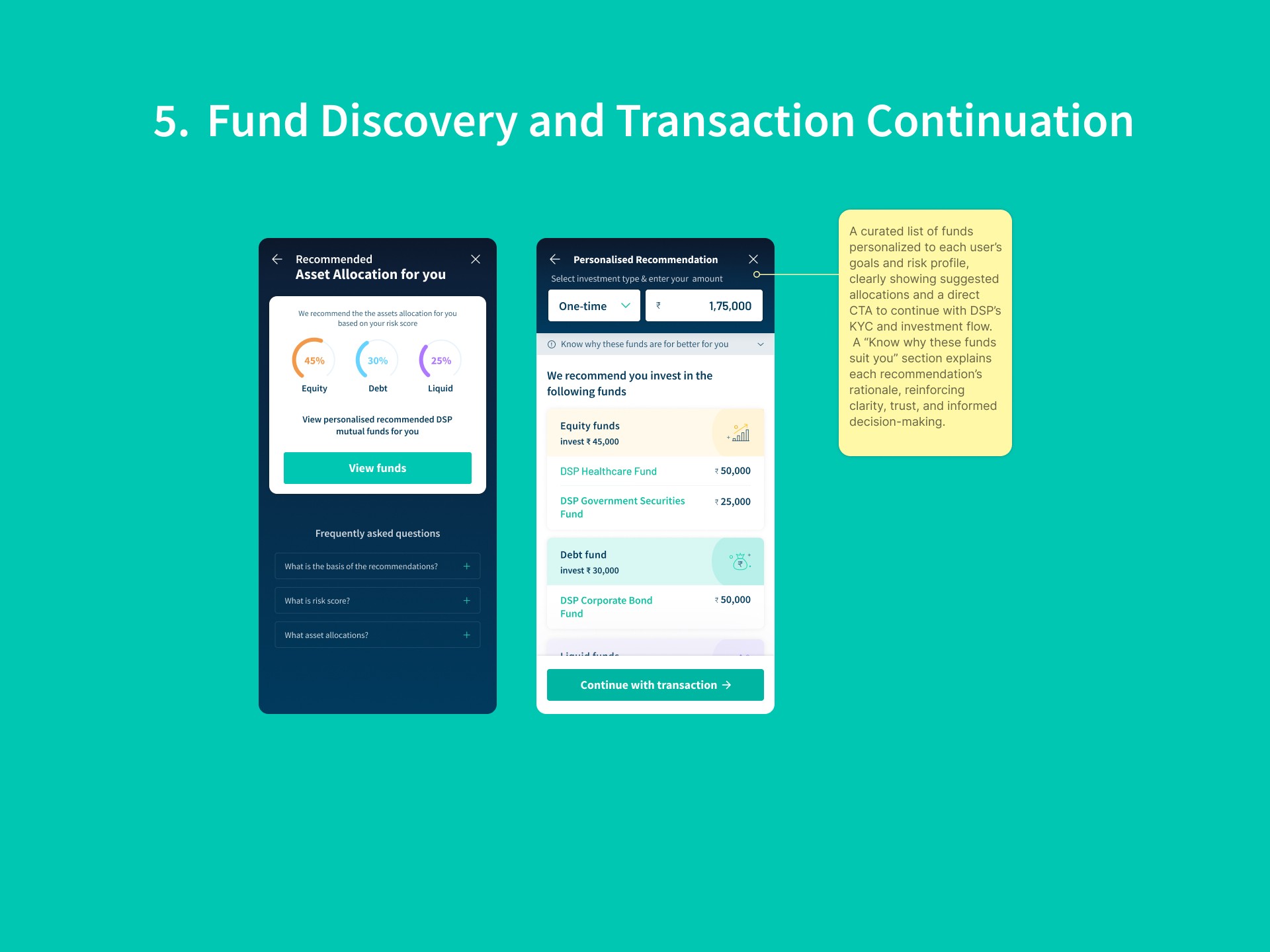

To address this, Sarthi was designed as a guided, questionnaire-based flow that understands user goals, risk appetite, and investment nature before suggesting personalized fund categories. The experience focused on simplicity, transparency, and education through clear visuals, contextual FAQs, and a seamless transition into DSP’s KYC and transaction process.

The result was a smoother, more confident investment journey — reducing decision time from 40 to 14 minutes, lowering drop-offs to 28%, and increasing first-time conversions to 27%. Sarthi transformed fund selection from a confusing search into a clear, goal-driven experience that empowers users to invest with confidence.